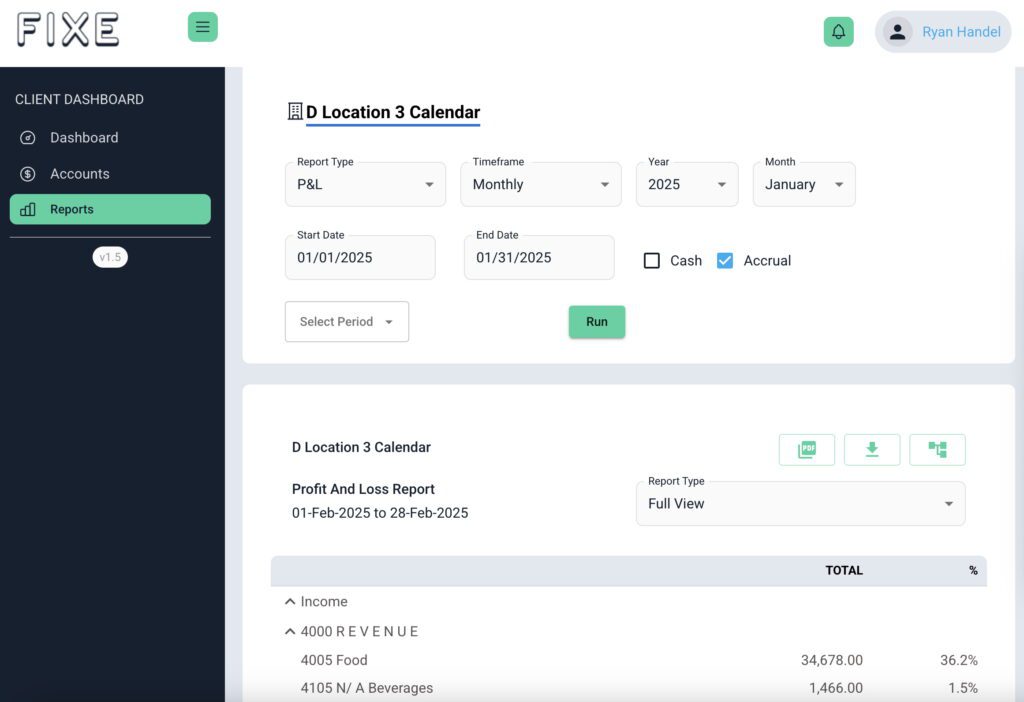

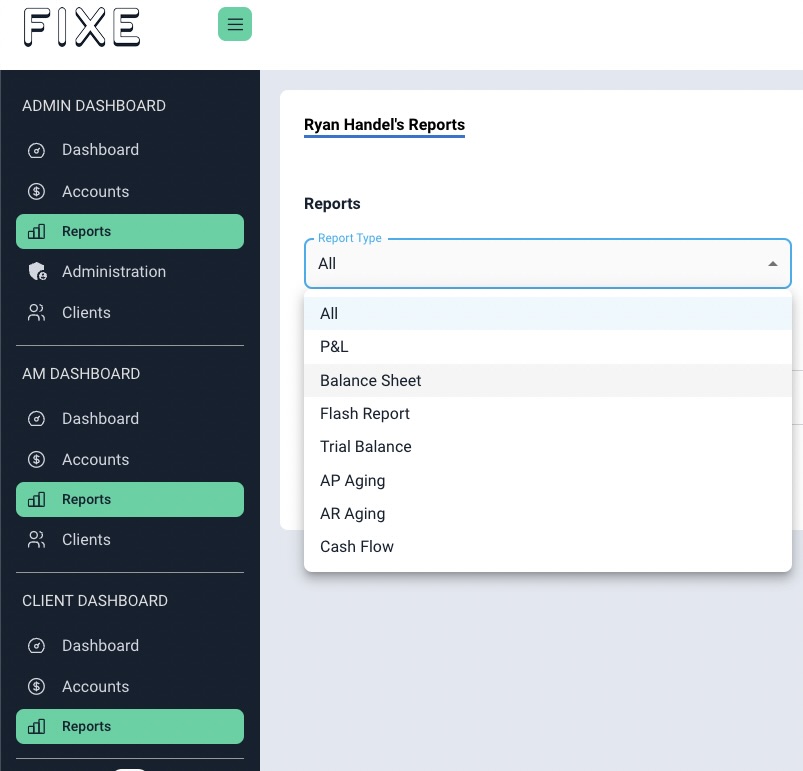

Depending on how comfortable you are and how your operations are set up, a single restaurant probably doesn’t need a Controller or a Director of Finance, especially if you’re using FIXE. FIXE does a good job of providing and outlining your financials. We make sure that the information is going into the right buckets, that you understand everything, and that we’re all on the same page.

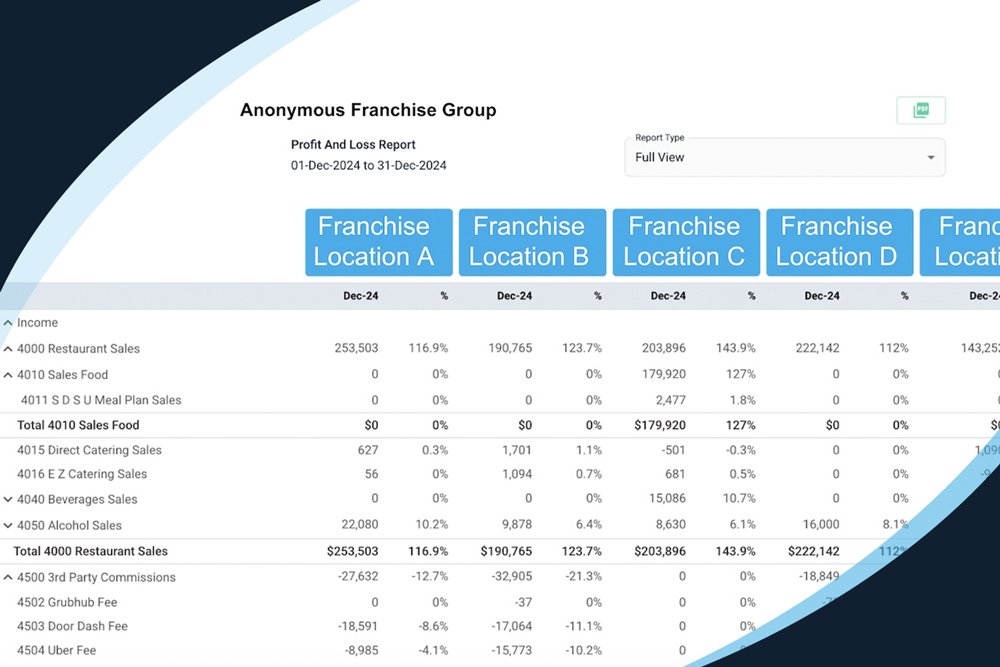

As you grow, you’ll have more locations and different revenue sources coming in. You’ll start to have corporate overhead and credit cards that get allocated to different locations. If you’re expanding quickly, you also might need some cash flow management. You should probably bring in some type of administrator or a Controller when you reach $7-8 million for the year in revenue.

CONTROLLER ROLES

We do a good job of getting financials ready at FIXE, but at a certain point, we need a liaison that helps bridge that gap between the bookkeeping work that we do and the final financial package that goes to the owners and operators. Someone that can say, “This expense is allocated to these locations,” or, “This is how the owner wants to look at it.” The owner doesn’t have time for those conversations because they’re trying to grow their business. That’s why it’s worth it for them to invest in a Controller.

We have a lot of clients with 5-10 or more locations. We enjoy working in tandem either with their Controller or some type of office administrator. FIXE is still going to handle all of the day to day bookkeeping and software management to make sure all the information is going to the right places, but you still want that extra set of eyes to analyze the numbers and to correct them.

Controllers are the people who should be paying the vendors, reviewing vendor statements, reviewing payroll, and making sure there are no errors. The Controller’s job is to represent how the owner wants expenses allocated. A lot of times groups buy things for multiple locations at the same time. They make sure expenses are allocated correctly and that clearly identify that to our account managers. FIXE account managers do as good of a job as they can, but we don’t have a crystal ball. If an expense needs to get split into the three different locations, we need that information. We won’t just assume it.

Controllers should have a sensibility about how they’re paying vendors and managing cash flow. The Controller isn’t expected to bring in revenue; they are managing what’s directly in front of them. They’re not forecasting down the road or laying down the framework for how to build your business. They’re just making sure that your current business is financially solid and under control.

CHIEF FINANCIAL OFFICER FUNCTIONS

There are a couple of types of CFOs. Some CFOs will help analyze your business and project cash flow. Other CFOs are really good at helping you fundraise or get lines of credit to help grow your business. Usually, it’s a different skill set. Not every CFO has both skill sets.

A CFO is going to cost you $150,000 a year at minimum. In order to justify that cost, your revenue should be $15-$20 million a year. You should bring in a CFO to:

- Dial in your financials to get ready for an investment

- Be a liaison between you and a bank to help get loans to grow further

- Help project cash flow as you start to expand restaurants

There’s a variety of reasons, but you don’t need a CFO when you’re making under $10 million a year. You probably just need a Controller, someone that can help review the financials.