A common point of confusion and frustration for business owners is the fact that their bank account balance seems completely misaligned with their Profit & Loss. I get calls all the time from distressed FIXE clients, and they say, “I don’t understand how I lost $30,000 last month when my bank account balance has been above $100,000 the whole month. What is going on?” There’s a lot more to your bank account balance and to your profitability. The two are somewhat related, but they’re different. This misunderstanding can lead to not having enough money in your account to function. Or to pay taxes.

If a big deposit hits your bank account, that’s not just for yesterday’s food and drink sales. It is also for your taxes, which will be collected on those sales. For most of my clients, which are in California, that is about 10%. A big chunk of that is not yours. That’s going to CDTFA (CA Department of Tax and Fee Administration) next month. The other portion is employee tips received through credit cards. Depending on the location, that could be a sizable chunk of your deposit. So if you’re looking only at your bank account to try to determine how much money you’re making, you’ll get a really distorted image because your deposits are not all your money.

The other thing that can happen is people will not understand the math. “Here were my sales yesterday. How do I break apart what actually got deposited?” The main elements of what gets deposited to your bank account is going to be your sales, minus discounts, plus sales tax collected, plus tips collected, minus credit card processing fees, for most points of sale. Some POS systems take credit card fees out separately, but the overwhelming majority take them out each day with their deposits.

In every point of sale where you integrate with 3rd party apps – for example, Toast – look at the deposit for that day’s worth of sales in your bank account. This number might be dramatically lower than expected. A lot of sales recorded in Toast that day might be coming through on a totally separate cadence because they’re from Uber Eats, DoorDash or Grubhub. It can be difficult to define exactly how sales translate to deposits in the bank account because there are a lot of different factors that impact it. That’s why it’s better to just look at your financial report to understand how much money you actually brought in that day.

Deposits from 3rd party app sales come in separately from point of sale deposits. That’s another thing that can totally confound the picture. For example, you integrated DoorDash, Uber Eats, and GrubHub in your point of sale. Say you made 100k in sales yesterday. If you look at the breakdown of where those sales came from, your point of sale deposits are only going to be sales in-person at your business. DoorDash, GrubHub and Uber Eats sales are going to come through separately on their own cadence. Typically, once a week, but I see varying times that they deposit. You can typically choose daily, weekly or monthly deposits within the third party app. That can also really throw off a picture.

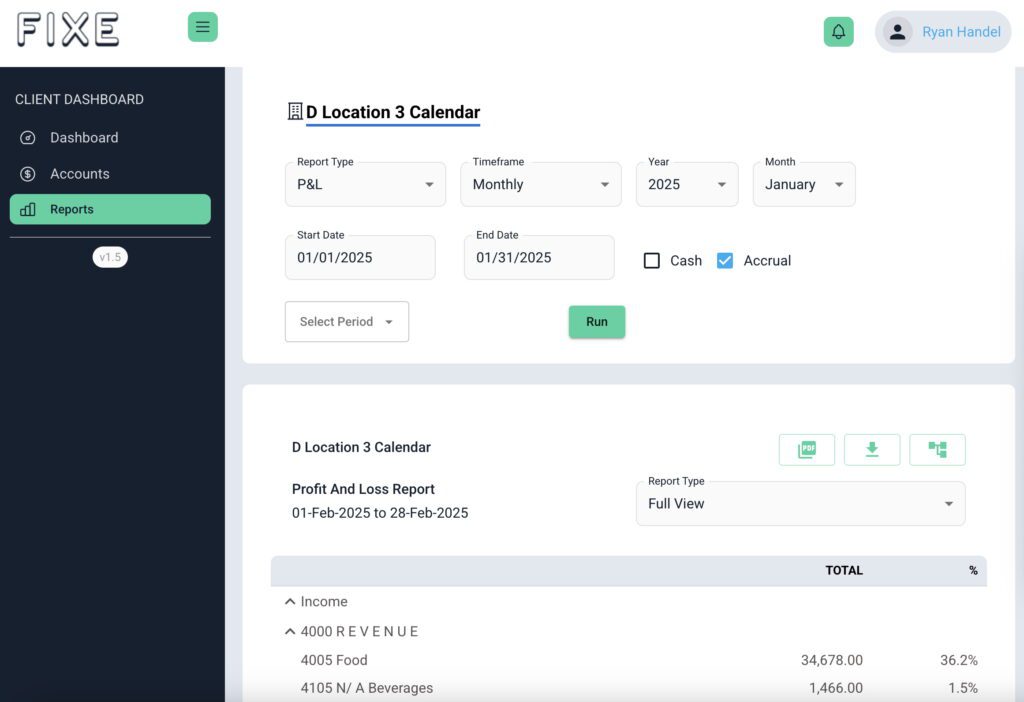

At FIXE, we separate out sales, sales tax, tips, and fees. You can pull a P&L for a single day, and you would be able to see your true sales for that day.

Operationally, if you’re trying to understand if you can afford to take out a loan and buy a new piece of equipment, be careful how you’re analyzing your cash flow and make sure that you’re interpreting it correctly.

OPTIONS TO CLEAR UP CONFUSION FROM MISMATCHED NUMBERS

1. USE FIXE

FIXE can help by breaking down the sales figures each day. For FIXE clients, this is already part of the program, and if you get confused, your account manager can walk you through it.

2. MOVE MONEY

I have some clients who guesstimate how much their sales are going to be every week. They say, “Okay, I’m going to move 10% of my estimated sales each week as an automatic transfer to my savings account. That way, when sales tax comes around, I’m not going to be shell shocked. I’m going to have roughly enough money already in my savings account set aside. So it’s not this giant hit to my cash flow once a month.” That’s a good approach.

3. USE TAX COMPLIANCE SOFTWARE

When people are concerned about cash flow, and feeling stressed out by the effects of these large monthly sales tax payments, there’s a software called Avalara (fka DAVO) that I set a lot of clients up on. There’s another software called TaxJar, which I’ve used less. Basically these sales tax compliance softwares plug into your point of sale. Automatically, every single day, you’ll see your Toast profit, and you’ll see a withdrawal from this company for the sales tax collected that day. So it mitigates that over depositing effect. Your bank account balance is truer to how much money you really have to work with. You’re not inflating your bank account balance with what’s essentially a liability. That’s what sales tax collected is until you pay it, a liability.

Avalara doesn’t pay the sales tax every day. They withdraw money that you collected the previous day. So instead of just having that money in your bank account and accidentally using it for payroll, to pay rent, or to pay vendors, they take it away and hold on to it. Then they automatically file your sales tax and your prepayments for you every month.