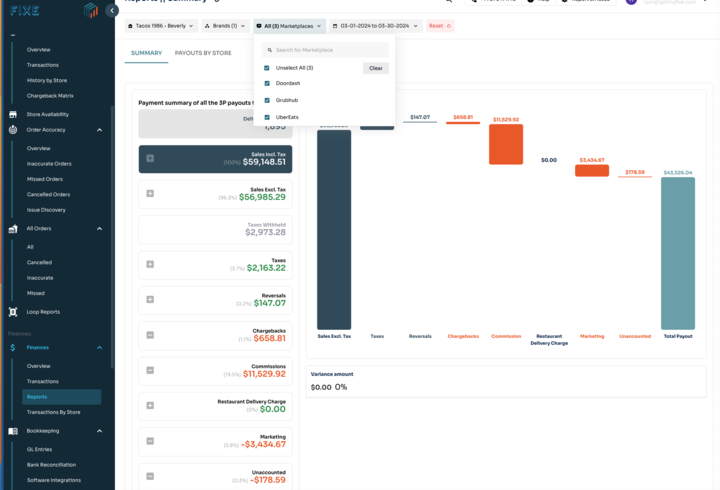

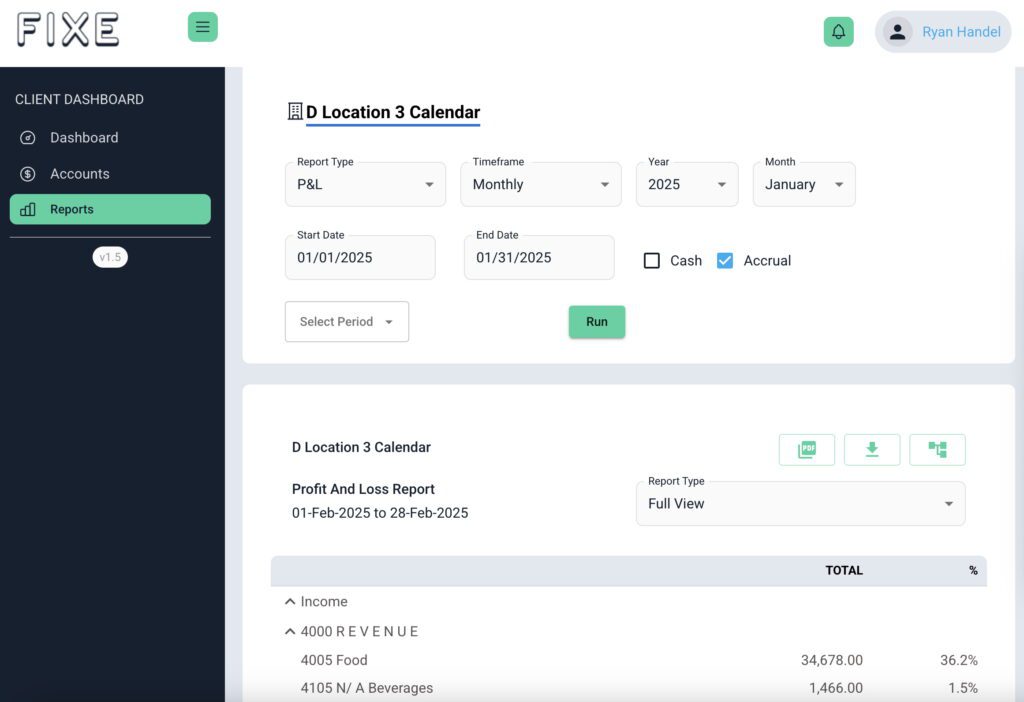

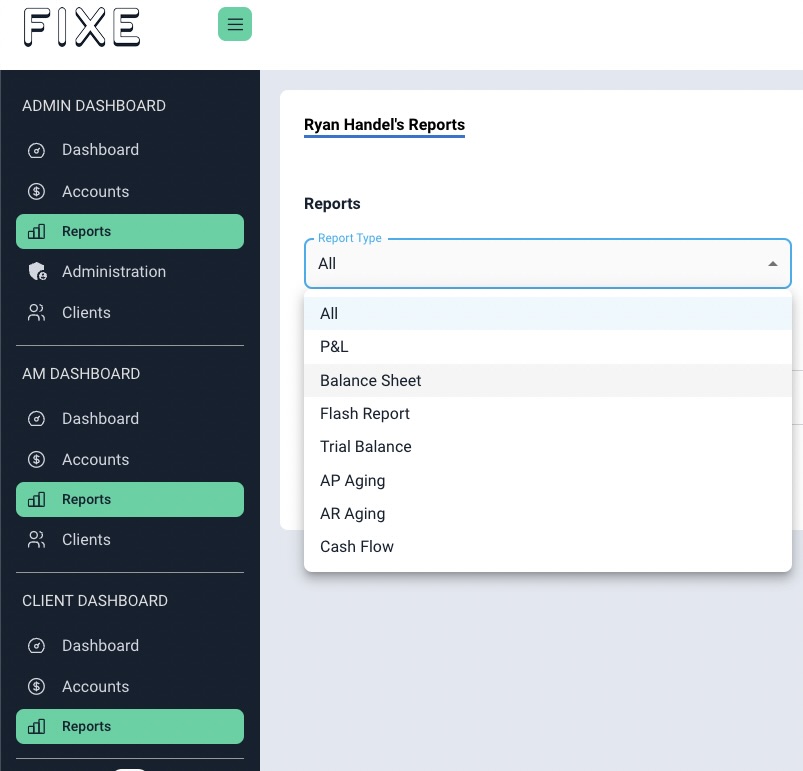

You can remain confident that people are fighting and winning dollars for your restaurant through our automatic customer chargeback dispute process. At any time, just log into our dynamic 3rd party app dashboard to get complete clarity on all payments and fees for DoorDash, GrubHub and Uber Eats thanks to our best in class software partnership with Loop. With that peace of mind, you can focus on other areas with 3rd party apps where it’s possible to increase awareness and performance while saving money and aggravation.

Where else to focus

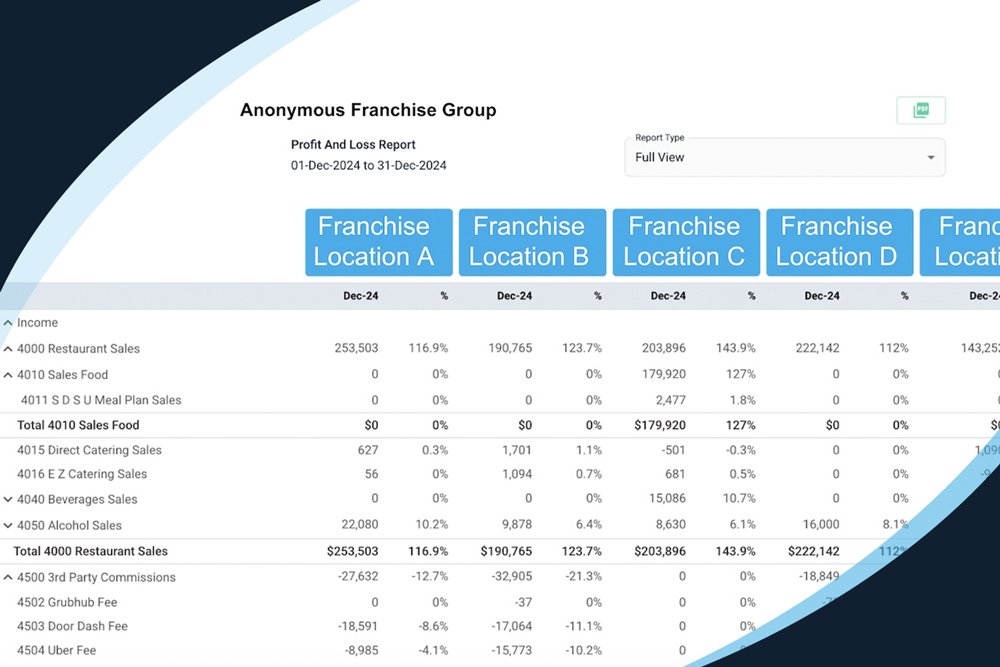

Don’t be blinded by your top line sales. Focus on what’s actually coming into your bank account, versus what you’re actually selling. A restaurant may think they’re doing great. “I’m selling $20,000 a month on Uber Eats!” Well, they’re a 3rd party app taking 30%.

People should also be more proactive about their commission rates. Before, restaurants didn’t really have much of a ground to negotiate on. They are now getting more negotiating power and more restaurants can negotiate to under 20% or less commission rates on most 3rd party apps.

People sign up for marketing offers on Uber Eats and DoorDash – buy one get one free, $5 off, things like that – and they see great sales coming in, but they have no idea if they’re dropping money from the bottom line. At the end of the month, when they see how little their deposits are compared to their sales due to the marketing dollars that these apps are collecting, it remains to be seen if that was really a viable thing. There are a lot of places you need to look, in order to see if you’re really profitable with 3rd party apps. That’s something we do a good job of at FIXE.

Seeing the performance of the marketing, and if it’s really driving additional revenue, that’s tough to do if you’re trying to run your restaurant, but using an app like Loop does give you a dashboard to see your performance on your marketing dollars and your returns on investment.

Making sure 3rd party apps are driving additional revenue without having to add additional labor is also important. On top of that, if you have the opportunity to charge more on the apps, I probably would because people are not as cost conscious when they’re buying on those apps.

One problem: when you directly integrate these 3rd party apps into your POS system, they usually pull the pricing directly from your POS system. You can’t charge more. However, at least in Toast and in Square, you can create a separate menu in your system that’s specific for the 3rd party apps that’s not visible to your servers. You could set it up that way, and connect those 3rd party apps directly to that separate menu that has the additional pricing.

Common misunderstandings to keep in mind

- POS systems will not calculate commissions and marketing dollars. That is something you have to calculate outside of the POS system.

- Verify if each 3rd party app is collecting sales tax on your behalf or not because it changes from state to state and app to app. In California, Uber Eats is paying sales tax on the restaurant’s behalf. A lot of restaurants were paying sales tax on all of their sales. So they were double paying sales tax on Uber Eats sales and they didn’t even know it.

- I can’t tell you how many restaurants, when they open or sign on with a new 3rd party app, forget about connecting their bank account. Or they connect the wrong bank account, and they don’t get a deposit for a month or two. They eventually get it, but you should be verifying if you’re getting deposits on a weekly basis for your 3rd party apps.