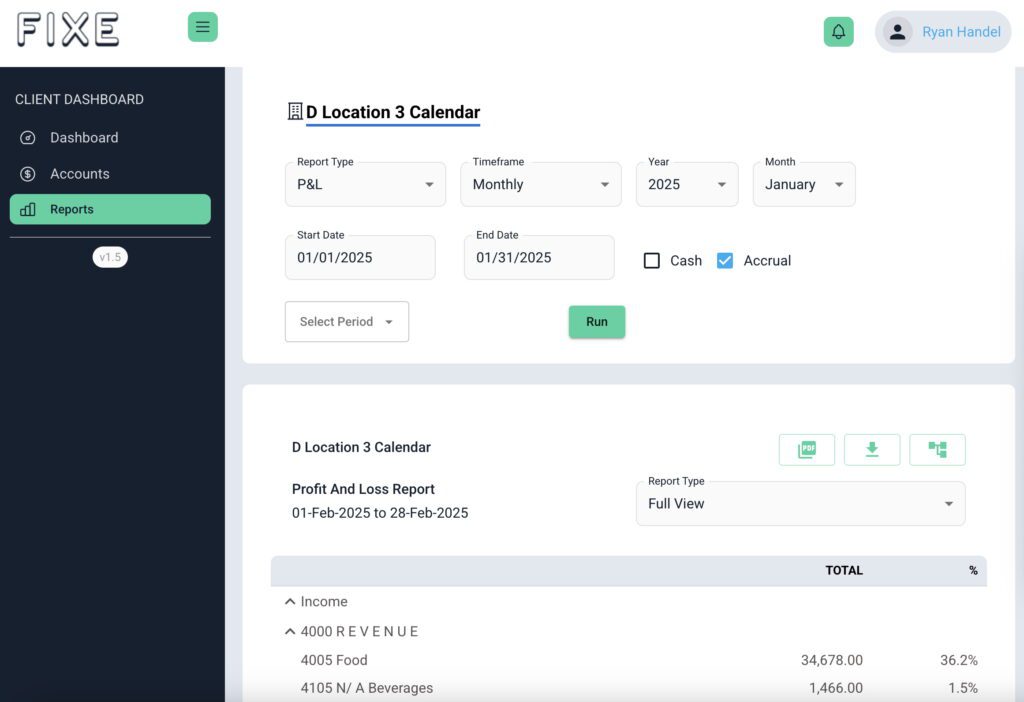

You are incurring expenses and recording them as the money leaves your bank account. Accrual spreads out expenses to make them more in touch with the period of time that expense covers, and less connected to the money that left your bank account that month. I prefer the word allocate while other people like amortize, but both terms are interchangeable with accrue.

In cash basis accounting, when money comes into the bank account, that’s when the sales are recorded. My sales for yesterday probably only hit the bank account today, so that would actually be recorded in cash basis accounting as today’s sales, not yesterday. If I go to the dentist, and it was a really expensive visit, say $500. The day that I went is when I incurred the $500 expense. Not necessarily when I paid for it.

Whether you use the accrual method or simply report expenses as they are incurred really depends on what you’re looking to get from your financials. If you’re looking for your P&L to help you better understand why your bank account balance feels so low right now, then you might not want to accrue expenses. You might just want to incur expenses and see them hit the P&L when they come out of your bank account.

For example, you might have a large quarterly workers comp payment every three months. That’s going to hit your P&L and you’ll notice a sizable workers comp expense that month. Seeing a $12,000 workers comp fee hit in June and then seeing nothing for July or August might really confound your financial picture, and it’s going to make July and August look unfairly better than June. For some people it makes more sense to see their financials this way. You can also choose to accrue that expense across the portion of time that expense actually covers.

I also ended up accruing big annual business license fees for the whole year for a lot of companies. They said, “I don’t want this multiple thousand-dollar charge to hit one month of my P&L. Please allocate this across 12 months.” It’s a little bit less standard for a budget to have one major annual charge in January and then nothing for 11 months. In a more typical budget, each month would have 1/12 of that giant charge, even if you just pay it in January.

Some companies closely monitor their financials each month, trying to control all of their costs, and trying to compare things. People who are really trying to drive their financials and have a system that is organized and standardized might want to accrue more expenses, as it allows things to be more consistent month over month.

Other restaurant operators are a little less involved with their financials. They’re not trying to put in a lot of work on their P&L. They really just want to see a report once a month and understand there are some natural fluctuations that come with running a business. With this approach, at the end of the year, simply incurring expenses and not allocating doesn’t make your books less accurate.

An accrued expense still gets incurred. You still pay for it. You may not be able to break up that quarterly workers comp bill or annual business license fee into fractional payments. If it’s for a full year’s premium, you probably still have to pay that full chunk all at once.

If you just split an expense evenly, divided by 12, and see the same exact expense every month for 12 months, that’s a really easy thing to look at and quickly understand. If you see one giant charge and then nothing for 11 months, you have to go back and ask yourself, why is that? Do I remember what happened here? It’s another thing that you need to remember and track.

Accrual is the more formal way to handle accounting. The standardization that comes from it is really the benefit. Accrual allows you to have an easier time comparing specific expense accounts month over month. Whereas with incurring you’re going to see a lot more variability month over month, and you’re going to have to be either not concerned with those fluctuations or dive further in to really understand what those fluctuations are and how they make sense.

If an expense is over $2,000, I would accrue it. If it’s under, don’t waste time. That’s really more effort than it’s really worth. This approach also follows GAAP (Generally Accepted Accounting Principles). No need to allocate smaller expenses. Every once in a while, I will see a client that wants to really dive in, and I appreciate that they want that level of detail. They’ll say, “This was actually six months worth of fees for this software. Can you divide the $500 out across six months?” I really don’t think that’s worth it. You’re getting too nitty gritty. You’re over complicating the picture. I really just recommend accrual for larger expenses that are going to dramatically impact your bottom line for a single month. In that case, I think it makes sense to allocate an expense out across multiple months.

If you’re a FIXE client, your account manager is probably the best person to help you make the decision of how to handle whether you want to accrue expenses versus just incurring them.

Definitely don’t switch from accrued to incurred accounting, or vice versa, midway through the year. It’s better to be consistent and not make a bunch of changes retroactively. Especially accrued versus incurred expenses. If you’ve just been incurring expenses and it’s August, I wouldn’t switch now, but you can think about it if you want to switch to accrual next year.