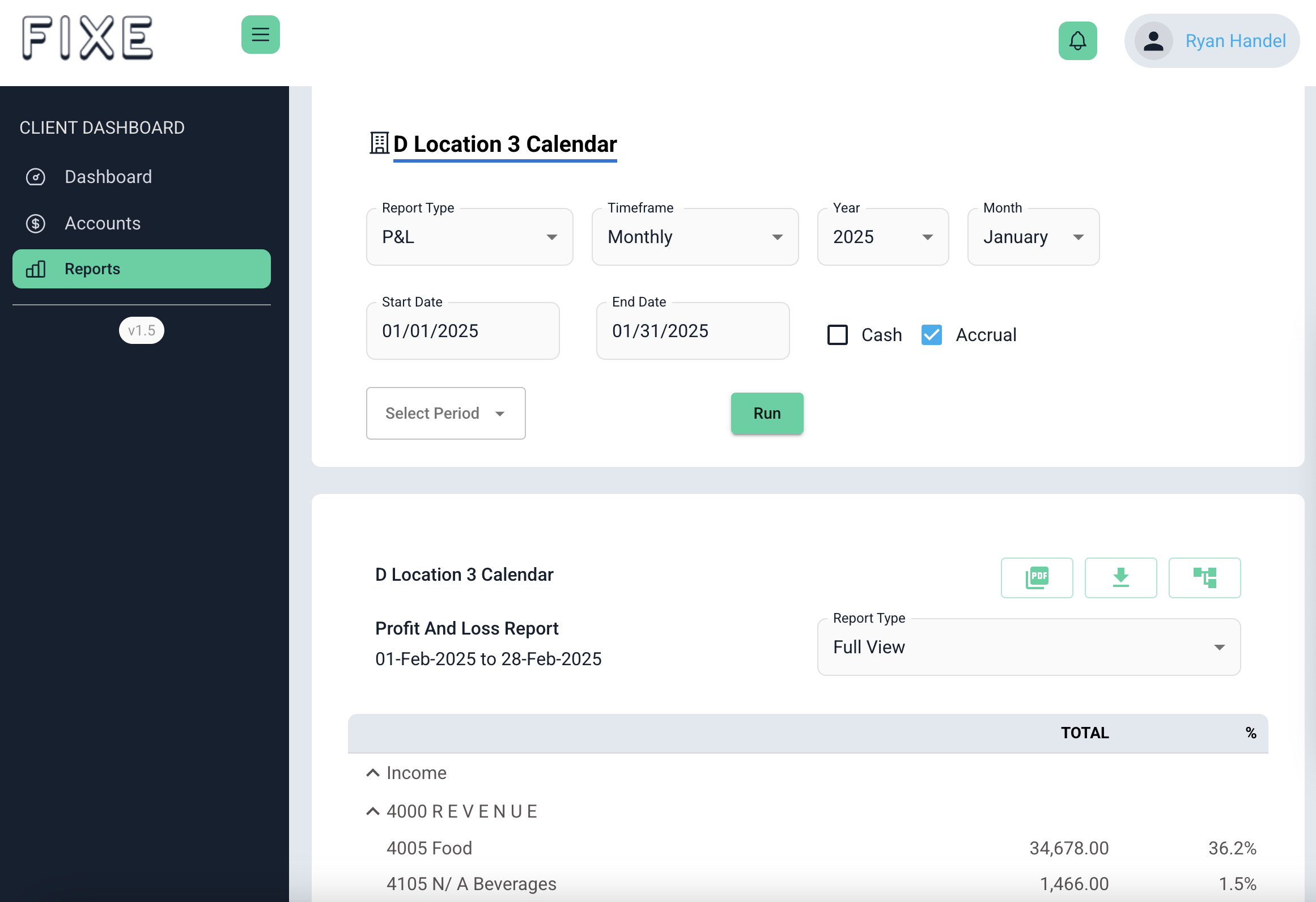

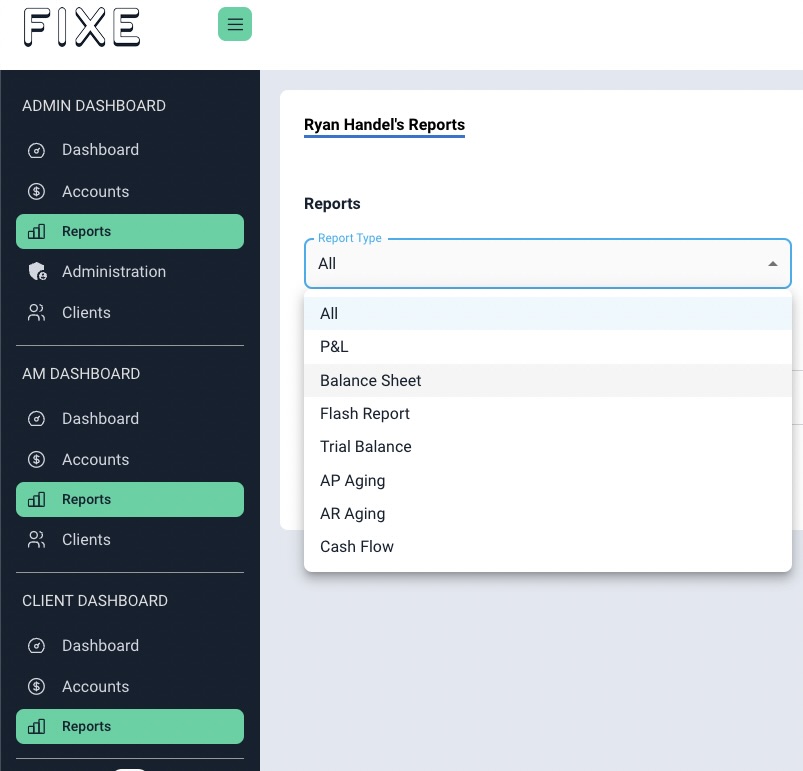

We train our Account Managers to review Profit & Loss statements to ensure accuracy. Here are a few tricks of the trade that I would encourage any of our clients to do as well, to verify everything looks correct.

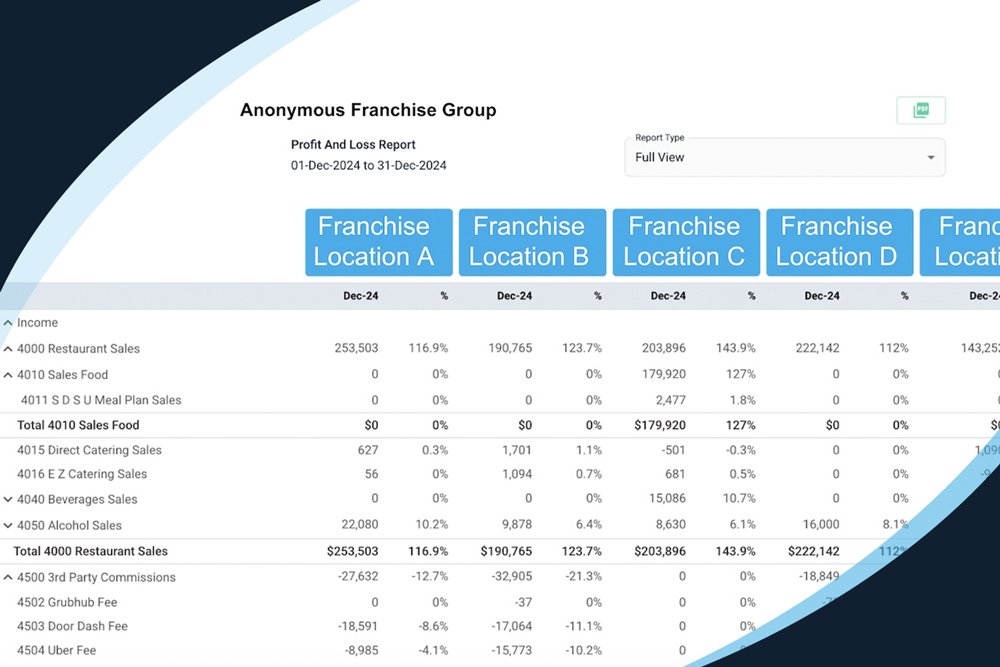

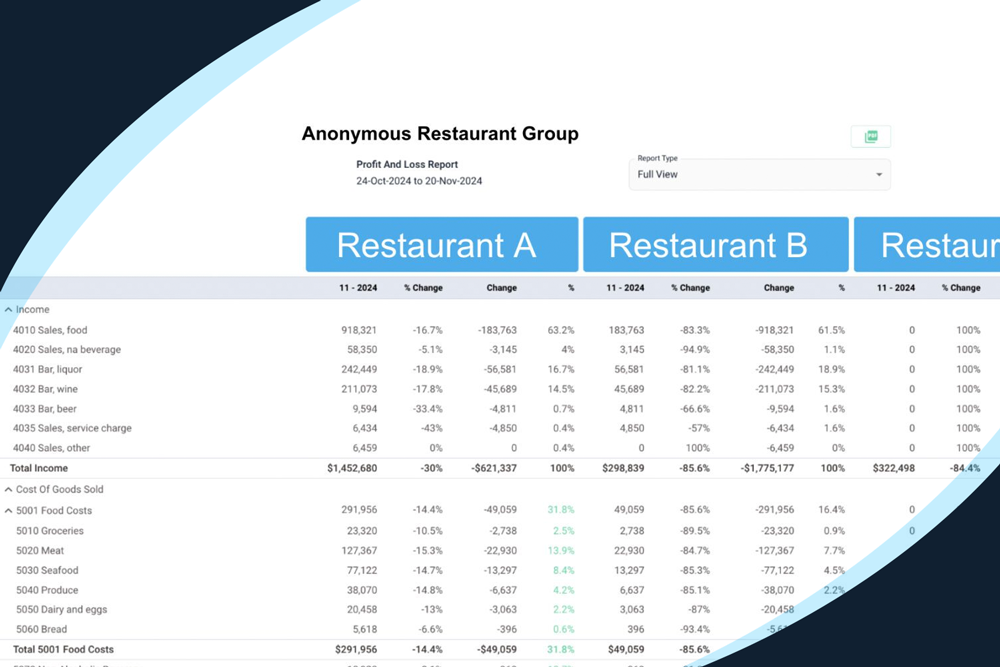

1) Always look at your P&L and compare it to the period before. By comparing this month to last month, it’s very easy to see if something looks far off, far down, or if something’s missing altogether. It’s easy to see if rent’s missing, utilities are missing, or the food cost has gone up.

2) Go through the General Ledger, also called the GL detail, or the detail. That’s basically a list of every transaction on your P&L, broken down line by line. It goes account by account, and then within the account, it shows all of the transactions. I’m looking for several things.

- Are there any duplicate expenses? If you’re a restaurant, you may have something that’s on auto pay. Let’s say your liquor vendor, Southern Wine & Spirits, is on auto pay. It’s an easy mistake to receive an invoice from Southern – let’s say you owe $500 – when that payment automatically comes out of the account, you’re supposed to be paying down that invoice for $500. But sometimes, if a bookkeeper’s careless or we don’t have all the information, we might add that $500 expense to the P&L. So now you have an invoice for $500 and a payment for $500, so that’s duplicating the expense. I always look to see if there are any vendors on auto payment that are duplicating any of those expenses. That’s easy to do in your cost of goods sold (COGS) categories.

- When you’re doing inventory, you always want to make sure you see the beginning inventory and an ending inventory. If you don’t, then your cost of goods sold are going to be out of whack.

- With your labor, you want to make sure you’re seeing all of the payrolls within the pay period. Just click into any of your payroll categories. Make sure, if you’re bi-weekly, you see two payrolls. If you’re weekly, you see four payrolls, and the corresponding accruals to adjust for those payrolls.

- As you go further down the P&L, you want to make sure none of the categories that you know you should be spending money on are missing. Whatever that might be. Like utilities. You pay for electricity every month. If you have a month where it’s not there, maybe we didn’t receive the bill. Maybe the date was a little funky, and we have to accrue it.

- Scan through the other accounts to make sure that you know there’s stuff in there.

The last thing on the P&L that you need to look at is your balance sheet, which I talked about on the Communal Table blog. You just want to make sure if nothing’s hiding on your balance sheet. If you don’t have a ton of time, I would look at two key areas that can impact your P&L.

- Look at your 3rd party accounts receivables – Door Dash – Postmastes, and Uber Eats – to make sure that seems right. The balance should always be roughly, like one week’s worth of deposits.

- Make sure your employee tips seem accurate. The only tips outstanding should be tips that you have to pay on the next payroll. Anything more than that or less than that, something is wrong.