When new clients join FIXE, we offer them the opportunity to update their records from past months. We provide this service so their financial reporting is consistent for the current year and for tax filing purposes. Some clients go back up to 3 years to correct and categorize expenses. This process also gives clients the chance to compare historical data for their business.

When we do a clean-up project, which we call a “FIXE up,” we typically start with the truth, which is your bank account. We review all of the transactions that occurred in your bank account and on your credit cards. That’s how we identify your expenses and bill payments throughout the chosen time period that we’re cleaning up. A lot of times we’re not able to retroactively get bills to see, so this review process ends up being a cash basis accounting clean-up.

Then we dial in your payroll and your sales exactly from your point of sale. We’ll get your payroll expenses from your payroll processor. We enter and clean up all of the transactions throughout the time period that we’re cleaning up. Then we go through and reconcile all of your accounts.

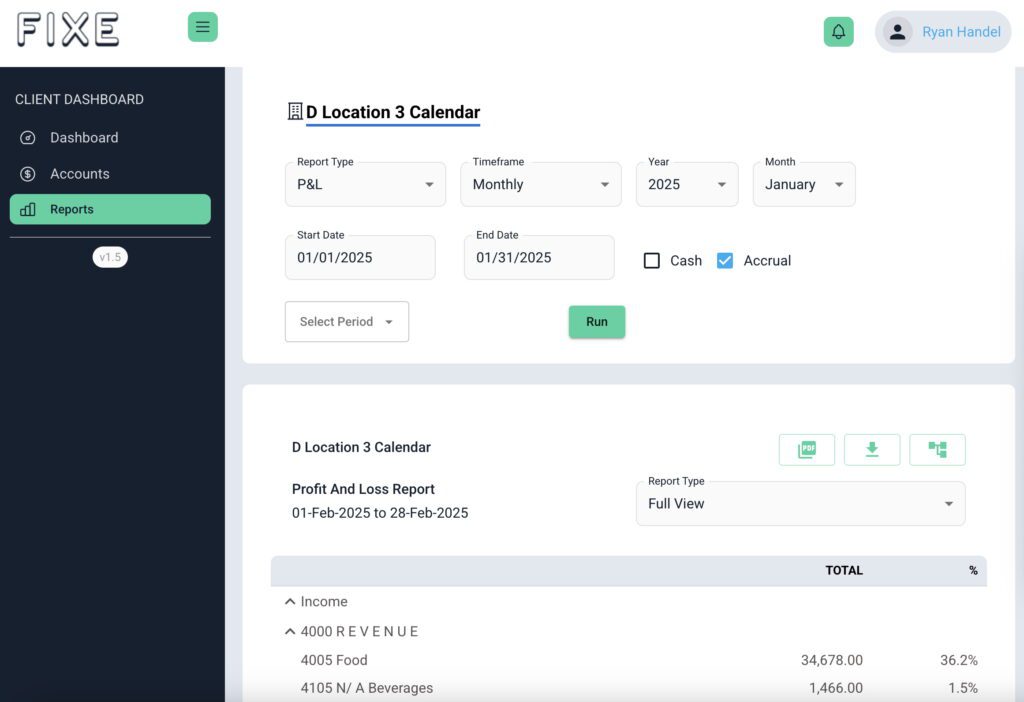

We review both your Profit & Loss and your balance sheet. Most of the time, what clean-up clients are really concerned about is the Profit & Loss. They want it to be as in touch with reality as possible. “In touch with reality” is the phrase that I use, because when you’re doing a retroactive clean-up, particularly the longer back in time that you go, you can’t get 100% perfect detail, but you can get it pretty close.

Your Cost Of Goods Sold in the month where FIXE was receiving the bills and doing the books for you is going to be detailed and organized. In a clean-up month, your bottom line is totally accurate, and a lot of your expenses are accurate, but that Cost Of Goods Sold is going to have less detail. It’s still going to be accurate, but you can’t find detail that doesn’t exist anymore.

Tax wise, the two things that are really important to be accurate are sales and payroll. Those are always really accurate. Your CPA will be really happy with the clean-up. Clients are typically really happy with the clean-up as well. After all, people usually don’t ask us to clean up books where everything is perfectly recorded. Either it was previously a complete mystery how they arrived at their current bank account balance or their restaurant bookkeeping was done really poorly, with a lot of mistakes, errors and duplicate transactions. We get their business to a place that’s 1,000 times better and allow operators to move forward together with complete clarity.

At the end of each night, you know what happened in the restaurant. You know you had a busy day. You know you’ve been running around trying to get everything under control. You know you’ve been analyzing your invoices, trying your best to make sure your process is in control. But if you’re not getting accurate reporting, you’re making all this effort, and in the end, you’re like, “How did I do? I have no idea.” You can look at your bank account balance and see it’s going up or down, but you don’t have a true picture of how you’re actually doing. We previously talked about how your bank account balance isn’t a very accurate read on your profitability.

- There’s no good way to know how you’re doing without getting accurate financials.

- You need timely financials. If you get your March P&L in June, that information is so old, it’s useless in terms of making a quick pivot operationally to make yourself more profitable. That’s old data. What happened in April and May?

- There’s a lack of transparency with some bookkeepers. Restaurateurs will say, “They’ve told me the numbers are right, but won’t show me how they got them. Nobody will walk me through it, and I just don’t think that this is right.” That kind of lack of transparency is something we definitely avoid at FIXE. We will walk you through all the things that we did to get to the bottom line of your financials, if that’s what you want.

When you switch accountants or bookkeepers, you’re not going to have a lot of preservation of your historical data. If you start with FIXE in the middle of 2024, for example, and we do your books all the way back through 2023, we can compare month over month against the previous year, and it will make more sense, because we categorize things consistently. The further you go back with a “FIXE up,” the bigger benefit it is for historical comparison’s sake.

We typically try to finish any clean-up project, no matter how large, within a month. A really complex clean-up might take a little longer, but at least the preliminary reporting would be done after one month. The shorter the clean-up project, obviously, the less time it takes us.

Restaurateurs find that a clean-up is beneficial for continuity with their books. They can look back in a longer range of time and feel confident that it was the same person that made those transactions. If they bring up an inquiry, they can ask an account manager and get an answer.