Restaurant bookkeeping

terminology can be confusing.

Our glossary demystifies terms and acronyms that you’ll commonly find when running your restaurant.

-

3rd Party App

platforms where customers can order delivery or pickup from restaurants on their phones or computers. DoorDash, GrubHub and UberEats are our 3 biggest platforms, with Ezcater gaining steam. -

4-4-5

Financial calendar with 4-week, 4-week and 5-week blocks each accounting quarter, versus monthly or 4 13-week accounting quarters. -

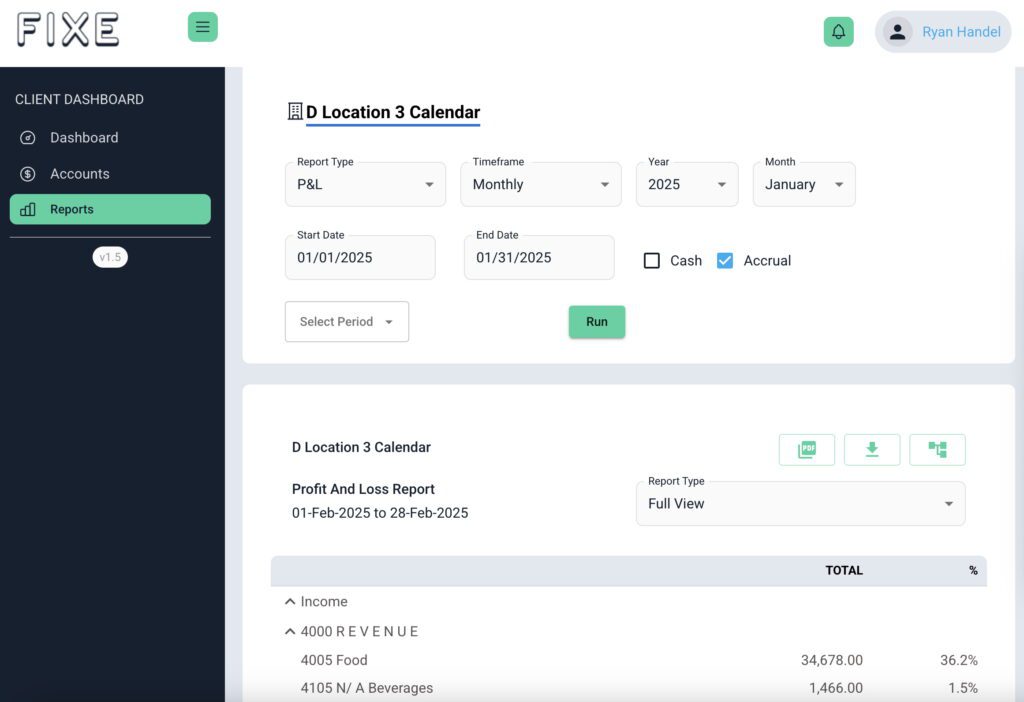

Accrual Based/Basis

Financials are based on the dates you incurred revenue and expenses, not based on the dates you paid for or received those expenses. -

ACH

Automated clearing house is the process of paying a vendor directly into their bank account vs a check or virtual credit. -

A/P

Accounts payable -

AP Aging

List of invoices or bills in QBO that are yet to be paid. -

A/R

Accounts receivable -

BS

Balance sheet -

Cash Based/Basis

Financials track revenue and expenses based on the dates money enters or leaves your bank account. -

COGS

Cost of Goods Sold – Cost of food and beverages associated with sales. This can also include paper supplies depending on the client. -

Direct Operating Costs

All costs outside of COGs and payroll associated with the day to day operations of running the restaurant. -

ERP

Enterprise resource planning -

Expenses below the line

All expense between NOI and net income -

FEIN

Federal employer identification number (also known as EIN) -

GAAP

Generally Accepted Accounted Principles. Financial Accounting Standards Board (FASB) is an independent NGO that establishes these accounting and financial reporting standards for public and private companies and non-profits. Governmental Accounting Standards Board (GASB) is a separate NGO that sets these standards for states and local governments. Both boards recommend forms of accrual accounting. -

GL

General ledger or PL detail (in QBO) -

Gross Revenue/Gross Sales

Revenue (less voids, sales taxes, tips and possible other service fees or deferred revenue such as gift card sales) before factoring in expenses. -

Gross Profit

Net revenue less COGs -

General & Admin (G&A) Costs

These are typically overhead costs, advertising, insurance, etc.,associated with running the restaurant. -

Incurred

You incur expenses and record them as money leaves your bank account. An accrued expense still gets incurred. -

KPI

Key performance indicators -

Net Income

NOI less taxes, interest, depreciation, amortization and typical items such as R&D, royalties and management fees. These items are more closely tied to a corporate office rather than the restaurant. -

Net Operating Income (NOI)

Prime profit less direct operating costs and administrative and general costs -

Net Revenue/Income (in QBO)

Gross revenue less discounts and 3rd party commissions (although this can be customized). -

P&L

Profit & loss statement -

Prime Profit

Gross profit less payroll costs -

QBO

Quickbooks Online -

ROI

Return on investment -

State Tax ID #

The name for this changes from state to state, but is needed to set up any payroll processing.